We’ve talked before about tools to help you make a budget. Hopefully you’ve started your own budget by now!

However, if you’re new to budgeting, you may have some questions about the principles of how to manage your finances on an ongoing basis.

Questions like: How do I know if I get double-charged? Should I be saving my receipts? Is it necessary to look at my statement since everything is online?

Let’s Start With Transactions

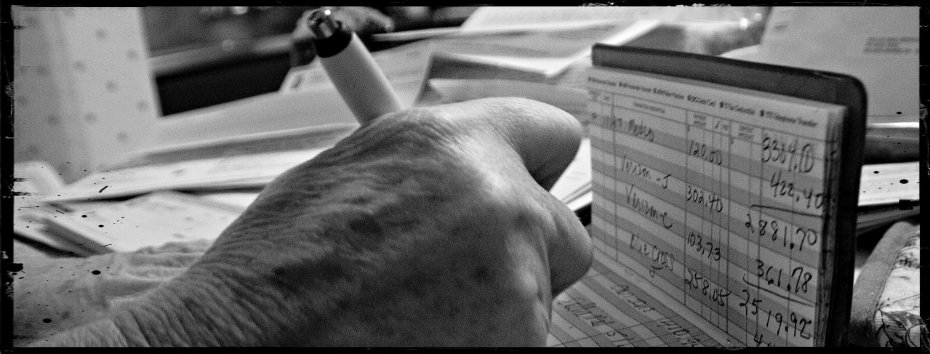

Before debit cards and credit cards took over, budget-conscious folks would use check registers to log all of their deposits and payments. They would write down every single transaction — the date, who was paid, what it was for, and the amount going in or out. They would also keep a running total of the amount of money available in the account.

At the end of the month, the bank would send a statement with their transaction record, and you would compare their record with yours. This would make it easy to catch any duplicate or suspicious charges (and give you a chance to double-check your math if the account totals didn’t add up).

Nowadays, fewer people actually write checks. But banks still send a statement every month. Most banks will send a paper version by default, but most let you opt for the “green” solution and send you an electronic version only.

Even though we don’t write as many checks any more, it’s still important to maintain your own record of spending. One option is to use the check register that comes with your checks, and add in the transaction type (CC, DC, check, cash).

However, if you don’t have a check register, or don’t want to write everything down as you go, there is an alternative approach that will help you accomplish similar goals: Save your receipts.

That means saying “yes” when the cashier asks if you want your receipt. It means having a slightly fatter wallet sometimes and making sure that you don’t lose them. But let’s assume you take your receipts home and put them into a folder that you’ll go through every week or two.

Take the Time to Review Your Transactions

Hopefully your receipts will be more organized than this.

The receipts serve as your transaction “register” of sorts — so now when you look at your bank statement (online or in paper), you have something to compare to.

Sometimes you’ll see a charge with a confusing abbreviated name that you don’t recognize. When that happens, flip through your receipts to the date it was posted and see if you can figure out what it was. Compare the amount of the transaction with your receipt to make sure it was you that spent that money.

As you go through your statement, you should also catch any duplicate charges. Sometimes, a vendor will submit the payment twice (or maybe you hit “Order Now” multiple times as you impatiently tried to order something online). When that happens, call your credit card company or bank and ask them to remove the charge. That process is less painful than it sounds (in my experience, at least).

If you don’t want to wait for your statement to come out, you can use a tool like Mint that automatically pulls in all of your transactions for you. Then you can stay on top of your spending as it happens, rather than let it pile up. Choose the working style that fits your schedule — just make sure that you review your transactions at least once a month.

Another nice thing about Mint (and other budgeting tools) is that it categorizes your transactions for you. So if you are reviewing your transactions in Mint, you can also verify the category that has been assigned, to make sure that your budget summaries are accurate each month.

One mis-categorization that has happened to me was with my rent. My apartment complex has the same name as a computer company, and so Mint assumed that I was spending thousands of dollars on electronics every month. But I caught that when I reviewed my transactions.

Mint (and other tools, I presume) let you “Split” transactions for the sake of accurate spending categorization. For example, when you go to Target, you might buy clothes, furniture, toys, and groceries all in the same trip. Those things should go into different spending categories, so being able to split a transaction helps you keep an accurate budget.

Reviewing Your Transactions Takes Some Time, But It’s Worth It

Yes, you may have to set aside some time in your schedule to review your transactions. But this is a great way to keep an eye on your spending. The more you know about how much you’ve already spent, the less likely you are to overspend that month.

Another related question would be “How long should I keep my receipts?” Really, that boils down to your own personal preference, but I would say a minimum of 30 days (60 days or more would be preferred). If you have the space, you could keep them for years if you wanted.

However long you keep your receipts, make sure it’s long enough to 1) give yourself proof of spending, and 2) give you time to return/exchange an item. Sometimes it’s better to get your money back rather than being forced to take store credit!

If you get overcharged, having that receipt is your insurance. Let’s say a restaurant charged you $140 for a $40 meal. Maybe a shady waiter added in an extra ‘1’ at the front of your total amount when you wrote in the tip. Maybe it was due to sloppy handwriting. Whatever the reason, it’s MUCH easier to email a copy of the receipt to the credit card company to prove that your meal was $40, and not $140.

So save your receipts, and review your transactions. That’s the best way to keep an accurate budget!

What do you do to keep track of your spending? Leave a comment below!

Recent Comments